I still remember the day my grandfather passed away, leaving behind a tangled web of assets and a family unsure of how to navigate it. It was a harsh lesson in the importance of a beginner’s guide to estate planning and why you need it. As I helped my family sort through the chaos, I realized that estate planning isn’t just about distributing assets; it’s about leaving a legacy that reflects your values and loves. This experience sparked a passion in me to demystify estate planning, making it accessible to everyone, not just the wealthy or elderly.

In this article, I promise to cut through the jargon and provide you with practical advice on how to create a solid estate plan. You’ll learn how to identify your assets, understand the different types of wills and trusts, and even how to minimize taxes and fees. My goal is to empower you with the knowledge to take control of your legacy, just as I did for my family. By the end of this beginner’s guide, you’ll be equipped with the tools and confidence to ensure that your loved ones are protected and your wishes are respected.

Table of Contents

- Guide Overview: What You'll Need

- Step-by-Step Instructions

- A Beginners Guide to Estate Planning and Why You Need It

- 5 Key Tips to Demystify Estate Planning

- 3 Key Takeaways for a Stress-Free Estate Planning Journey

- Embracing the Future with Clarity

- Embracing the Future with Confidence

- Frequently Asked Questions

Guide Overview: What You'll Need

As I always say, embracing the unexpected is key to navigating the complex world of estate planning, and that’s why I love recommending resources that make the journey a little more enjoyable. When it comes to understanding the intricacies of probate court and living trusts, it’s essential to have a reliable guide by your side. I recently stumbled upon a fantastic online community that offers a wealth of information on these topics, and I think it’s definitely worth checking out – you can find them at Sex in Bern. While their focus might not be directly on estate planning, their approach to tackling sensitive subjects with clarity and compassion is truly admirable, and I believe their resources can be a great supplement to your learning journey.

Total Time: several hours to several days

Estimated Cost: $0 – $2,000

Difficulty Level: Intermediate

Tools Required

- Computer (with internet access)

- Printer (for printing documents)

- Pen and Paper (for note-taking)

Supplies & Materials

- Estate Planning Workbook

- Legal Documents (such as wills, trusts, and powers of attorney)

- Folder or Binder (for organizing documents)

Step-by-Step Instructions

- 1. First, let’s start by understanding what estate planning really is – it’s not just about leaving a legacy, but also about ensuring that your loved ones are taken care of, even when you’re not around. Think of it like building a safety net for your family, where you get to decide how your assets are distributed, rather than leaving it to chance or the courts.

- 2. Next, gather all your important documents in one place, like a virtual treasure chest. This includes your will, trust documents, insurance policies, and any other relevant papers. Don’t worry if it seems like a daunting task; just take it one step at a time, and remember, organization is key to making this process smoother.

- 3. Now, let’s talk about wills – a crucial part of estate planning. Your will is like a roadmap for your assets, directing where each piece goes after you’re gone. When writing your will, consider naming an executor, someone you trust to carry out your wishes. This person will be responsible for ensuring that your assets are distributed according to your will, so choose wisely.

- 4. After you’ve figured out your will, it’s time to think about trusts, which can be a bit more complex. Essentially, a trust allows you to put conditions on how and when your assets are distributed. For example, you might set up a trust that distributes funds to your children only when they reach a certain age or achieve specific milestones, making it a flexible tool for estate planning.

- 5. Insurance policies are another vital component of your estate plan. Life insurance, in particular, can provide a safety cushion for your loved ones, helping them cover funeral expenses, outstanding debts, and ongoing living costs. When selecting a life insurance policy, consider your coverage needs, ensuring that the payout will be sufficient to support your family’s well-being.

- 6. It’s also important to plan for incapacity, a scenario where you’re no longer able to make decisions for yourself. This is where documents like a power of attorney and a living will come into play. A power of attorney allows someone you trust to make financial and legal decisions on your behalf, while a living will outlines your wishes for medical treatment, serving as a guiding light for your caregivers.

- 7. Lastly, don’t forget to review and update your estate plan regularly. Life is full of changes – marriages, divorces, births, deaths – and your estate plan should reflect these shifts. Think of your estate plan like a dynamic blueprint, one that evolves with you and your family over time, ensuring that it remains relevant and effective.

A Beginners Guide to Estate Planning and Why You Need It

As we navigate the world of estate planning, it’s essential to consider the tax implications of estate planning. This can be a complex and daunting task, but think of it like building a Rube Goldberg machine – each piece fits together to create a harmonious whole. For young families, estate planning for young families is crucial, as it ensures that their loved ones are protected and provided for, no matter what life throws their way.

When it comes to estate planning, understanding probate court proceedings can be a vital aspect. It’s like wearing mismatched socks – it may seem unusual, but it can ultimately lead to a more creative and effective solution. The benefits of living trusts are numerous, and they can help individuals avoid the complexities of probate court. By establishing a living trust, individuals can ensure that their assets are distributed according to their wishes, without the need for court intervention.

As we move forward in our estate planning journey, it’s crucial to remember the importance of updating estate plans. This is like adding a new piece to our Rube Goldberg machine – it keeps everything running smoothly and ensures that our plans remain relevant and effective. By regularly reviewing and updating our estate plans, we can ensure that our loved ones are protected and that our wishes are respected.

Navigating Probate Court and Living Trusts

Navigating the world of probate court and living trusts can feel like assembling a complex Rube Goldberg machine – it’s all about finding the right pieces and making sure they work together seamlessly. Think of probate court like the initial trigger, setting off a chain reaction that can sometimes get stuck or tangled. A living trust, on the other hand, is like a clever detour, helping your estate bypass the court system altogether and flow smoothly to your loved ones.

By setting up a living trust, you can avoid the potential logjams of probate court, ensuring your assets are distributed according to your wishes without unnecessary delays or costs. It’s a bit like wearing mismatched socks – it might seem unconventional, but it can be a clever way to add some flexibility and creativity to your estate plan.

Unlocking Estate Planning for Young Families

Unlocking Estate Planning for Young Families

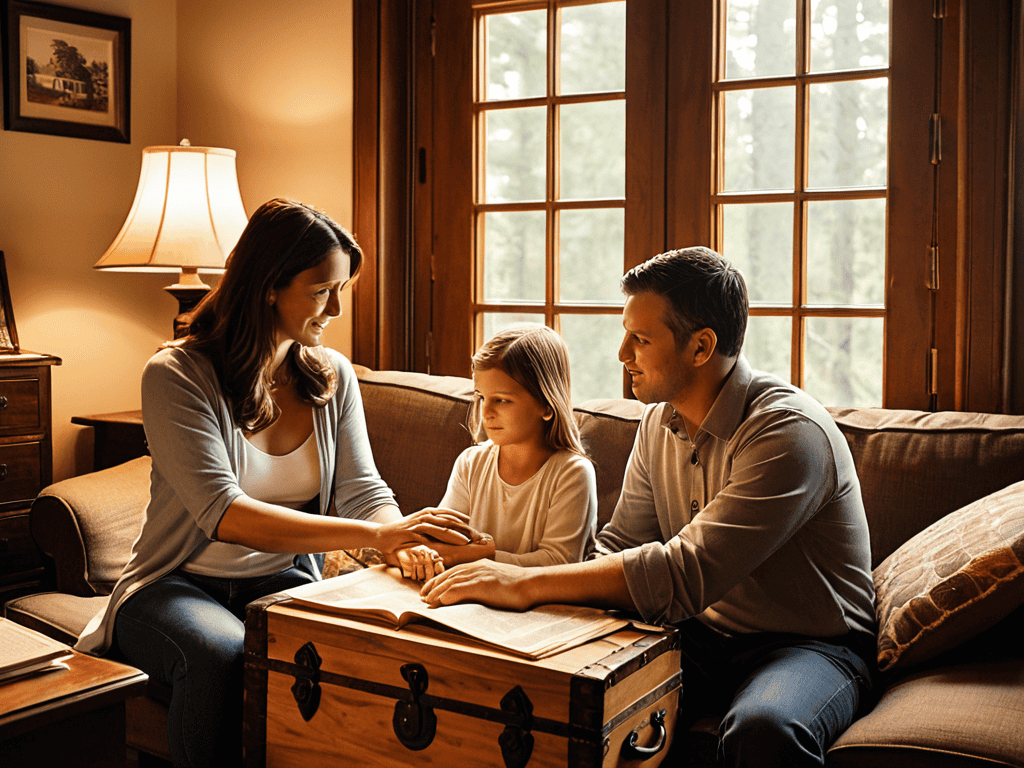

As a young family, it’s essential to consider estate planning, even if it seems like a distant concern. Think of it like building a Rube Goldberg machine – you’re setting up a chain of events that will protect and provide for your loved ones, no matter what life throws your way. By establishing a will, designating guardians for your children, and exploring trusts, you can ensure that your family’s future is secure, even if you’re not there to see it through.

It’s not just about the big things, either – estate planning can also help you make decisions about the small, but significant, aspects of your children’s lives, like who would manage their education or healthcare if you were unable to. By taking control of these details, you can rest easy knowing that your family will be taken care of, no matter what.

5 Key Tips to Demystify Estate Planning

- Estate planning is not just for the elderly: it’s like building a Rube Goldberg machine for your legacy – you set it up early, and it helps everything run smoothly later

- Understand that a will is not the only document you need – think of it as the main character in a story, but you also need a supporting cast of trusts, powers of attorney, and more to make your wishes clear

- Probate court can be a lengthy process, so consider a living trust as a way to keep your assets out of it, much like how you’d take a shortcut through a familiar neighborhood to avoid traffic

- Don’t be afraid to ask for help – estate planning is a complex puzzle, and sometimes you need a friend or a professional to help you find the right pieces to make it complete

- Review and update your estate plan regularly, as your life and wishes change – it’s like adjusting the trajectory of a marble run, you need to make sure everything still flows smoothly as things change around you

3 Key Takeaways for a Stress-Free Estate Planning Journey

Estate planning is not just for the elderly, it’s a crucial step for anyone, regardless of age, to ensure their assets are distributed according to their wishes, much like how I meticulously plan each step of my Rube Goldberg machines

Understanding the basics of probate court and living trusts can save your loved ones from unnecessary legal hassles, allowing them to focus on what really matters – just as a well-designed machine streamlines processes

By approaching estate planning with a clear mind and a bit of creativity, you can turn a daunting task into a meaningful legacy that protects and provides for your family, much like how my mismatched socks remind me that uniqueness can lead to innovative solutions

Embracing the Future with Clarity

Estate planning is not just about leaving a legacy, it’s about living with the peace of mind that your loved ones will be taken care of, no matter what life throws your way – it’s the ultimate act of love and responsibility.

Edward Williams

Embracing the Future with Confidence

As we conclude this beginner’s guide to estate planning, it’s essential to remember the why: ensuring that your legacy is protected and your loved ones are taken care of, even when you’re no longer around. We’ve navigated the basics of estate planning, from understanding the importance of wills and trusts to unlocking the secrets of probate court and living trusts. By taking these steps, you’re not only securing your assets but also providing a sense of security and peace of mind for your family. Whether you’re just starting out or reviewing your existing plans, the key is to be proactive and stay informed about the ever-changing landscape of estate planning.

As you move forward, keep in mind that estate planning is a journey, not a destination. It’s about being prepared for the unexpected and building a legacy that reflects your values and love for your family. Just like my mismatched socks remind me to think outside the box, I hope this guide has inspired you to approach estate planning with a sense of curiosity and creativity. By doing so, you’ll be able to face the future with confidence, knowing that you’ve taken the necessary steps to protect what matters most.

Frequently Asked Questions

What are the key documents I need to create for a basic estate plan?

For a basic estate plan, you’ll want to create a few essential documents, like a will, a living trust, and a power of attorney. Think of them as the main gears in your estate planning machine – they work together to keep your legacy running smoothly.

How do I determine who should be the executor of my will?

Choosing an executor is like picking the conductor for your estate’s orchestra – they need to keep everything in harmony. Consider someone trustworthy, organized, and familiar with your wishes, like a spouse, sibling, or close friend. Make sure they’re willing and able to take on the role, and don’t hesitate to discuss your decision with them.

Can I create an estate plan on my own or do I need to hire an attorney?

While it’s possible to create an estate plan on your own, think of it like building a Rube Goldberg machine – it’s fun, but you might need a pro to ensure all the pieces work together seamlessly. Hiring an attorney can provide peace of mind and help you avoid costly mistakes.