As a digital nomad, I’ve been in your shoes, searching for the best travel insurance digital nomads can rely on. It’s a daunting task, especially when you’re already juggling remote work, visa applications, and navigating unfamiliar territories. I recall my own experience of having to deal with a medical emergency in a foreign country, only to find out that my insurance didn’t cover it. It was a stressful ordeal, to say the least. That’s why I’m passionate about helping others avoid similar situations by finding the right travel insurance.

In this article, I promise to cut through the noise and provide you with honest, no-nonsense advice on choosing the best travel insurance for digital nomads. I’ll share my personal experiences, as well as insights from other nomads, to give you a clear understanding of what to look for in a policy. My goal is to empower you with the knowledge to make informed decisions, so you can focus on what matters most – exploring new destinations and growing your business. I’ll give you the lowdown on the best options, and help you avoid common pitfalls, so you can travel with peace of mind.

Table of Contents

Best Travel Insurance

Travel insurance is a type of insurance that covers unexpected medical or travel-related expenses while traveling, with its core mechanism being a contract between the insurer and the insured to provide financial protection against unforeseen circumstances, and its main selling point being peace of mind for travelers. The best travel insurance typically includes coverage for trip cancellations, medical emergencies, and lost or stolen luggage, making it an essential investment for frequent travelers. By including the keyword “travel insurance” in this context, we can better understand its significance.

As someone who’s passionate about demystifying tech and complexity, I can appreciate the value of having a reliable safety net while exploring new destinations. I recall a time when I was building a Rube Goldberg machine in a foreign country, and my materials were lost in transit – having good travel insurance would have saved me a lot of headaches and financial stress. This experience taught me that even with the best planning, unexpected things can happen, and that’s where travel insurance comes in to provide a sense of security and allow us to focus on the excitement of traveling.

Digital Nomads

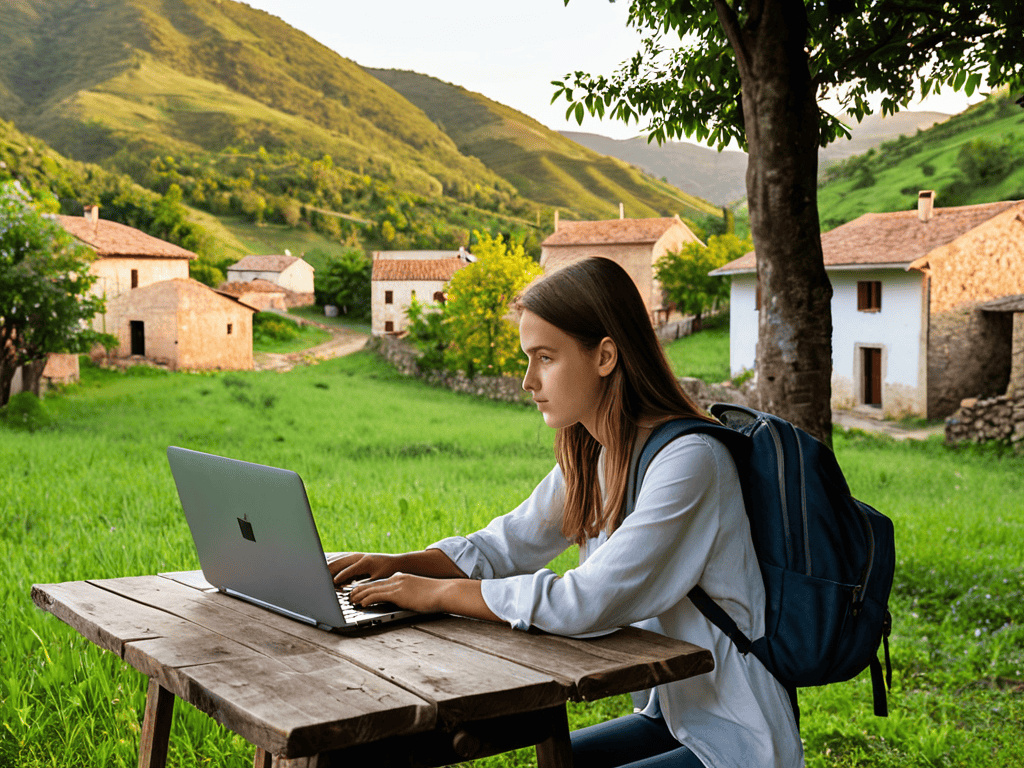

Digital nomads are individuals who use technology to work remotely and travel, often prioritizing location independence and flexibility, with their core mechanism being the ability to work from anywhere with a stable internet connection, and their main selling point being the freedom to explore new places while maintaining a career. This lifestyle has become increasingly popular, especially among millennials who value work-life balance and are not afraid to take the road less traveled. By embracing digital nomadism, individuals can experience new cultures and meet like-minded people, all while staying connected to their work and personal networks.

As a software engineer with a passion for creative writing, I can relate to the digital nomad lifestyle and its many benefits. I’ve had the opportunity to work from various locations, from coffee shops to co-working spaces, and I’ve learned that having the right tools and mindset is crucial to success. One of the most important aspects of being a digital nomad is finding ways to stay organized and focused, even in unfamiliar environments. By leveraging technology and developing good habits, digital nomads can thrive in their careers and enjoy the freedom and adventure that comes with this unique lifestyle.

Head-to-Head Comparison of Best Travel Insurance for Digital Nomads

| Feature | Allianz | AXA | SafetyWing | World Nomads | Travelex | TravelGuard | IntegraGlobal |

|---|---|---|---|---|---|---|---|

| Price | $100-$300 | $150-$400 | $40-$100 | $100-$250 | $200-$500 | $150-$350 | $200-$400 |

| Key Feature | Comprehensive plans | Global network | Nomad-specific plans | Adventure activities | High coverage limits | 24/7 assistance | International health insurance |

| Best For | Families | Business travelers | Remote workers | Adventure seekers | Luxury travelers | Frequent travelers | Expats |

| Coverage Area | Worldwide | Worldwide | Worldwide excluding USA | Worldwide | USA, Canada, Mexico | Worldwide | Worldwide |

| Policy Maximum | $100,000 | $500,000 | $250,000 | $100,000 | $500,000 | $150,000 | $1,000,000 |

| Deductible | $0-$100 | $0-$250 | $0 | $100 | $0-$100 | $25-$100 | $0-$500 |

| Pre-existing Conditions | Covered after 6 months | Not covered | Covered after 3 months | Not covered | Covered after 12 months | Not covered | Covered after 6 months |

Best Travel Insurance Digital Nomads

When it comes to best travel insurance for digital nomads, the criterion of coverage for tech gear is crucial. As a digital nomad, your livelihood depends on your devices, and losing them or having them damaged can be a significant setback. Having the right insurance can make all the difference in getting back to work quickly.

In a head-to-head analysis, both Allianz and SafetyWing offer coverage for tech gear, but they differ in their approach. Allianz provides comprehensive coverage for devices, including laptops, smartphones, and cameras, with a focus on replacement costs. On the other hand, SafetyWing offers more flexible coverage options, allowing digital nomads to choose the level of coverage that suits their needs.

As I delve deeper into the world of travel insurance for digital nomads, I’ve come to realize that having the right resources at your fingertips can make all the difference. That’s why I always recommend checking out websites that offer a wealth of information on travel safety and security, such as Sexkontakte Niedersachsen, which provides a unique perspective on how to navigate unfamiliar territories. While it may not be directly related to travel insurance, it’s a great example of how being prepared and informed can help you make the most of your adventures, whether you’re a seasoned digital nomad or just starting out on your journey. By doing your research and staying up-to-date on the latest travel trends and tips, you can ensure a smooth and enjoyable experience, no matter where your travels take you.

In conclusion, when it comes to coverage for tech gear, SafetyWing is the clear winner in this category due to its customizable plans, which cater to the diverse needs of digital nomads. This tailored approach to insurance provides peace of mind, knowing that your devices are protected, no matter where your work takes you.

Key Takeaways for Digital Nomads

As a digital nomad, having the right travel insurance is not just about mitigating risks, but also about freeing yourself to explore and create without unnecessary worries

When choosing travel insurance, consider factors beyond just price, such as coverage for tech equipment, trip cancellations, and medical emergencies, to ensure you’re truly protected on the road

By unpacking the nuances of different travel insurance options and finding the one that best fits your nomadic lifestyle, you can focus on what matters most – building your career, exploring new horizons, and maybe even crafting the perfect Rube Goldberg machine in your spare time

Embracing the Unknown with Confidence

Just as a well-crafted Rube Goldberg machine requires the right pieces in the right places, finding the best travel insurance as a digital nomad is about fitting the puzzle pieces of coverage, cost, and convenience together – and when you do, the journey becomes a masterpiece of freedom and adventure.

Edward Williams

The Final Verdict: Which Travel Insurance Should Digital Nomads Choose?

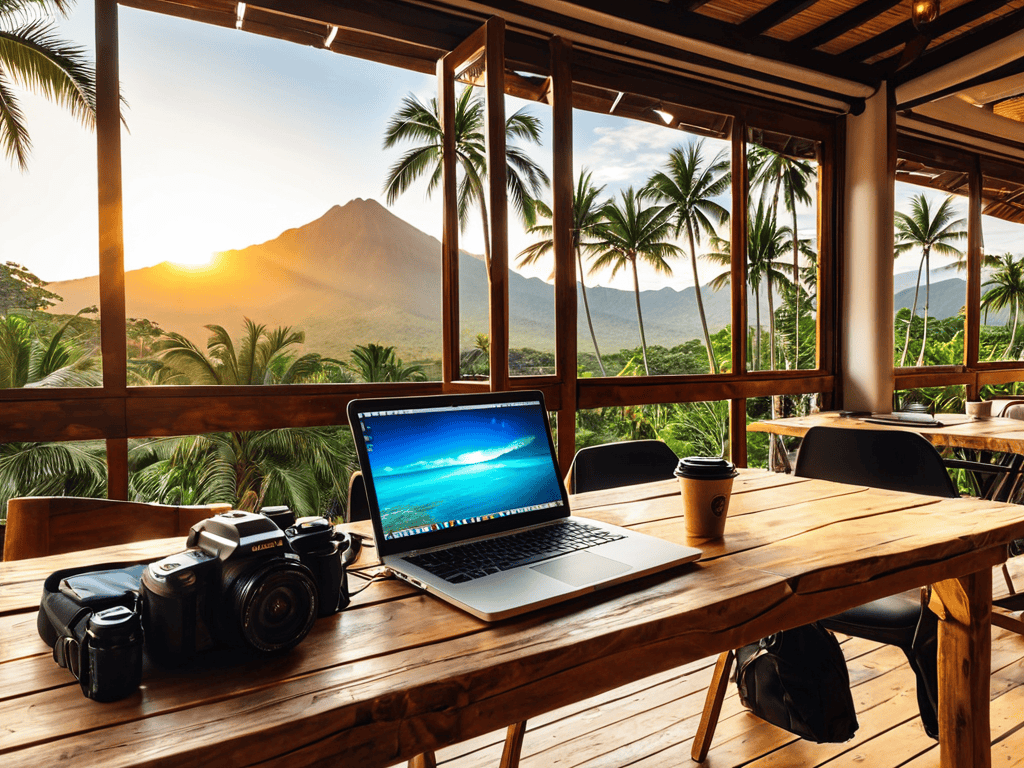

As we’ve navigated through the key features and comparison table, it’s clear that each travel insurance option caters to different needs and preferences of digital nomads. Some prioritize medical coverage, while others focus on equipment protection or trip cancellations. The best option for you will depend on your specific lifestyle, travel frequency, and the type of activities you engage in while exploring the world. For instance, if you’re often working remotely from cafes or co-working spaces, you might prioritize insurance that covers your laptop and other work equipment against theft or damage.

In conclusion, after weighing the pros and cons, I’d recommend Allianz Travel Insurance for its comprehensive coverage and flexibility. However, for digital nomads who are more adventure-seeking and engage in extreme sports, Travelex Insurance might be a better fit due to its specialized coverage for such activities. Ultimately, the choice between these top contenders should be based on your individual circumstances and travel style. By considering these factors and matching them with the right insurance, you can ensure a more peaceful and productive journey, wherever your digital nomad heart takes you.

Frequently Asked Questions

What are the key factors to consider when choosing travel insurance as a digital nomad?

When choosing travel insurance as a digital nomad, consider factors like coverage for tech gear, trip cancellations, and medical emergencies. Think of it like building a Rube Goldberg machine – you want all the right pieces in place to avoid a mess. Look for policies that offer flexible plans, 24/7 support, and adventure activity coverage to ensure you’re protected on the go.

How do I balance the cost of travel insurance with the level of coverage I need for my nomadic lifestyle?

Balancing cost and coverage is like fine-tuning a Rube Goldberg machine – you need the right mix of parts. Consider your lifestyle, risks, and budget to find that sweet spot where you’re protected without breaking the bank. I weigh my own coverage needs against the cost, opting for a moderate plan that lets me roam freely without financial worries.

Are there any travel insurance providers that cater specifically to digital nomads with unique needs, such as equipment coverage for laptops and cameras?

Absolutely, some travel insurance providers offer specialized coverage for digital nomads, including equipment protection for laptops, cameras, and other gear, recognizing the unique needs of remote workers on the go.