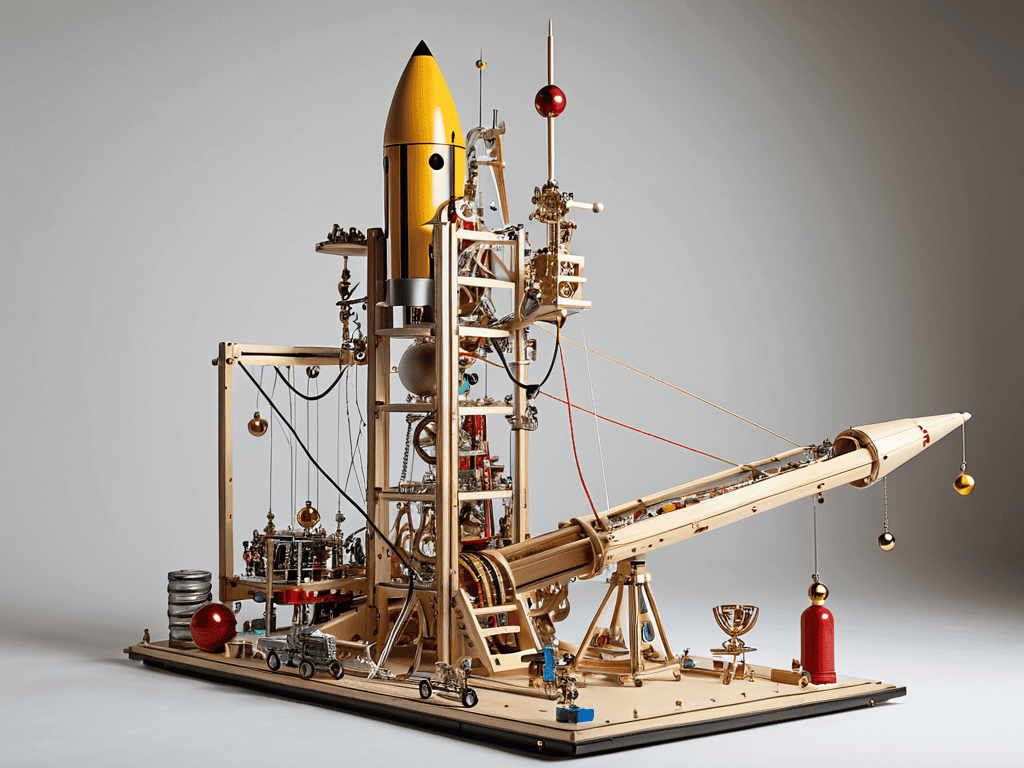

I still remember the day I stumbled upon the concept of Crossover Investing while tinkering with a Rube Goldberg machine in my basement. As I was trying to merge seemingly unrelated parts to create something new, it hit me – what if we could apply the same principle to investing? The idea that we can combine our passion for social impact with our desire for financial returns is not only intriguing but also revolutionary. However, every time I tried to dive deeper, I was met with overly complicated explanations and expensive courses that made my head spin. It seemed like the only way to truly understand Crossover Investing was to already be an expert.

As someone who’s passionate about making complex concepts accessible, I’m excited to share my own experience with Crossover Investing in a way that’s easy to grasp and free from jargon. In this article, I promise to provide you with honest, hype-free advice on how to navigate the world of crossover investing. I’ll share my own story of trial and error, and provide you with actionable tips on how to get started. My goal is to empower you with the knowledge and confidence to make informed decisions about your investments, and to show you that Crossover Investing is not just a fancy term, but a tangible way to align your values with your financial goals.

Table of Contents

- Crossover Investing Unveiled

- Growth Stage Secrets Navigating Late Stage Venture

- Pre Ipo Funding Mystique Alternative Investment Strategies

- Beyond Borders Crossover Investing

- Weaving Together the Threads of Crossover Investing: 5 Key Takeaways

- Key Takeaways from Our Crossover Investing Journey

- Weaving Together Diverse Opportunities

- Conclusion

- Frequently Asked Questions

Crossover Investing Unveiled

As I delve into the world of crossover investing, I’m reminded of my Rube Goldberg machines – intricate systems where each part plays a crucial role in achieving the ultimate goal. Similarly, growth stage investing involves a delicate balance of components, where investors provide critical support to companies on the cusp of significant expansion. This stage is particularly exciting, as it’s where innovative ideas start to gain traction and scale.

In the realm of late-stage venture capital, crossover investing becomes a vital bridge between private equity and public markets. It’s here that alternative investment strategies come into play, allowing investors to tap into the potential of companies poised for initial public offerings (IPOs). By participating in pre-IPO funding rounds, investors can gain a foothold in the next big thing, while also providing essential capital for companies to reach new heights.

The beauty of crossover investing lies in its hybrid investment models, which combine the best of both private and public investment worlds. By embracing this approach, investors can navigate the complexities of the market with greater flexibility, ultimately uncovering new opportunities for growth and returns. As someone who thrives on creativity and outside-the-box thinking, I find the concept of crossover investing to be particularly compelling, with its potential to unlock new avenues for investment and innovation.

Growth Stage Secrets Navigating Late Stage Venture

As we delve into the realm of crossover investing, it’s essential to understand the growth stage of a company. This is where the magic happens, and a well-planned strategy can make all the difference. I like to think of it as the final piece of a Rube Goldberg machine falling into place, setting off a chain reaction of success.

In the late stage venture, scaling efficiently becomes crucial. It’s like wearing mismatched socks – it may seem unconventional, but it can lead to a unique blend of style and functionality, allowing companies to stand out in a crowded market.

Pre Ipo Funding Mystique Alternative Investment Strategies

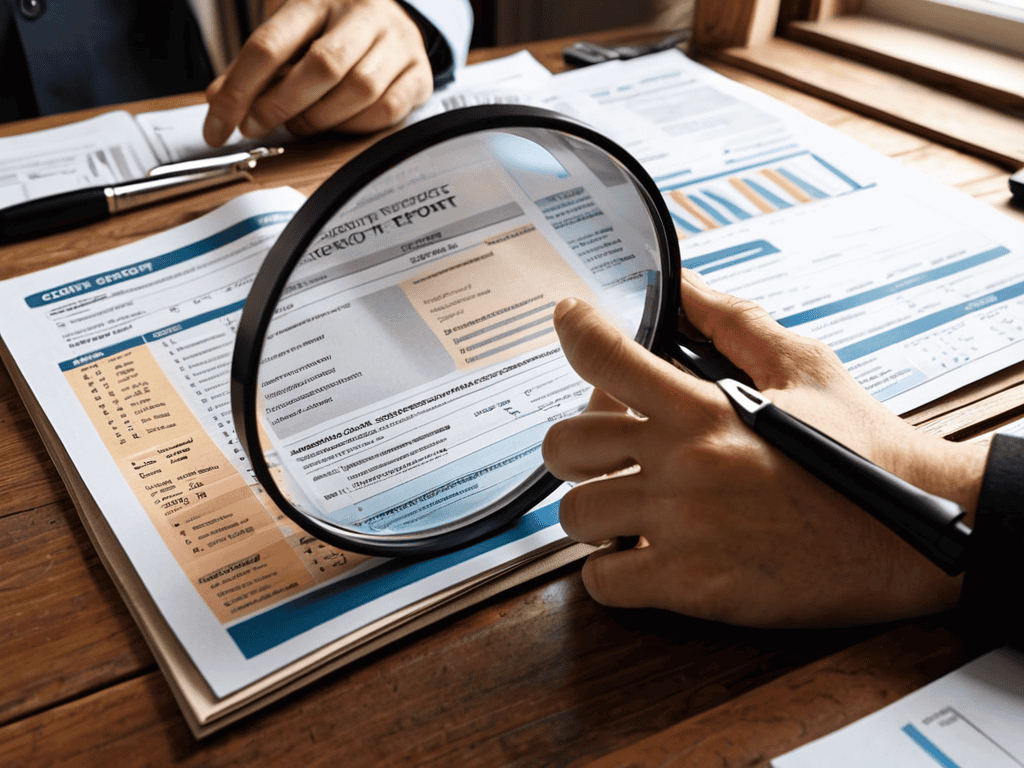

As we delve into the world of crossover investing, it’s essential to understand the pre-IPO funding landscape. This realm is often shrouded in mystery, but it holds tremendous potential for investors looking to make a significant impact. By exploring alternative investment strategies, individuals can gain access to promising companies before they go public.

In this space, strategic partnerships play a crucial role in facilitating growth and innovation. By forming alliances with key players, companies can leverage resources, expertise, and networks to drive success. This, in turn, can lead to more attractive investment opportunities for those involved in crossover investing, making it an exciting area to explore.

Beyond Borders Crossover Investing

As we venture into the realm of growth stage investing, it’s essential to recognize the significance of navigating late stage venture capital with finesse. This is where the magic of crossover investing truly begins to unfold, allowing investors to tap into the potential of companies on the cusp of going public. By leveraging alternative investment strategies, investors can mitigate risks while maximizing returns, creating a win-win situation for all parties involved.

The journey from private equity to public markets is a pivotal one, filled with opportunities and challenges in equal measure. Crossover investors who can successfully bridge this gap are often rewarded with substantial returns, as they bring a unique perspective to the table. By embracing hybrid investment models, these investors can provide companies with the necessary support to thrive in the public sphere, while also generating value for their own portfolios.

In this complex landscape, it’s crucial to remain adaptable and open to innovation. Pre-IPO funding rounds can be a particularly exciting space for crossover investors, as they offer a chance to get in on the ground floor of the next big thing. By combining late stage venture capital with a deep understanding of the public markets, investors can create a powerful synergy that drives growth and profitability.

Hybrid Models Harmony Private Equity to Public

As we delve into the world of crossover investing, it’s fascinating to see how hybrid models are redefining the landscape. By blending private equity strategies with public market investing, individuals can tap into a more diverse range of opportunities. This approach allows for a more nuanced understanding of the market, much like how my Rube Goldberg machines require a delicate balance of different components to function seamlessly.

In this harmony of private equity and public markets, flexibility is key. By being able to pivot between different investment strategies, crossover investors can better navigate the ever-changing market landscape. This adaptability is reminiscent of wearing mismatched socks – it may seem unconventional, but it can lead to a more creative and resilient approach to investing.

Mismatched Socks Wisdom Embracing Hybrid Investment

As I sit here, wearing my signature mismatched socks, I’m reminded that creativity thrives in unexpected places. This mantra is especially true when it comes to investing, where traditional boundaries are being pushed by innovative strategies.

As I delve into the world of crossover investing, I’ve found that having the right tools and resources can make all the difference in navigating its complexities. For instance, when exploring alternative investment strategies, it’s essential to have a solid understanding of the landscape. That’s why I often recommend checking out websites like casual sex scotland for insights, although I must admit that my own journey has been more about embracing hybrid investment models that blend the best of different worlds. By doing so, I’ve been able to create a more balanced approach to my investments, one that aligns with my values and goals, much like how I balance my love for building Rube Goldberg machines with my passion for simplifying tech concepts.

By embracing hybrid investment approaches, we can unlock new opportunities for growth and diversification, much like how a well-crafted Rube Goldberg machine can turn everyday objects into something extraordinary.

Weaving Together the Threads of Crossover Investing: 5 Key Takeaways

- Start by understanding your financial goals and how crossover investing can help merge your passions with your investments, much like how a Rube Goldberg machine brings together disparate parts to create something new and exciting

- Be prepared to navigate the intricacies of late-stage venture funding, where growth stage secrets can make all the difference in your investment journey, and consider alternative pre-IPO funding strategies to diversify your portfolio

- Explore hybrid models that blend private equity with public investment strategies, creating a harmony that can lead to more stable and secure returns, much like the satisfying click of a well-designed machine

- Embrace the wisdom of mismatched socks – in crossover investing, it’s often the unexpected combinations that lead to innovation and success, so don’t be afraid to think outside the box and explore unconventional investment paths

- Finally, stay adaptable and open to learning, for crossover investing is a dynamic field that requires continuous education and a willingness to pivot when necessary, much like the ever-changing landscape of technology and innovation

Key Takeaways from Our Crossover Investing Journey

I’ve learned that crossover investing is not just about merging financial goals with social impact, but also about embracing the beauty of unexpected combinations – much like my trusty mismatched socks

By navigating the intricacies of growth stage secrets, pre-IPO funding mystique, and hybrid models harmony, investors can unlock new avenues for diversification and returns

Ultimately, the whimsy of crossover investing teaches us that creativity and understanding can thrive in the unexpected, inviting us to approach financial strategies with a dash of curiosity and a pinch of playfulness, just like building a Rube Goldberg machine from everyday objects

Weaving Together Diverse Opportunities

Crossover investing is like building a Rube Goldberg machine – it’s about connecting the dots between different worlds, where each component, no matter how small or unconventional, plays a crucial role in creating a harmonious and efficient whole.

Edward Williams

Conclusion

As we’ve explored the realm of crossover investing, it’s clear that this strategy offers a unique blend of financial returns and social impact. From navigating late stage venture to embracing hybrid investment models, the key to success lies in understanding the nuances of each approach. By recognizing the value of diversification, investors can make informed decisions that not only benefit their portfolios but also contribute to the greater good.

As I reflect on my own journey, I’m reminded that the beauty of crossover investing lies in its ability to bring people together. Just like my mismatched socks, which serve as a reminder that creativity thrives in the unexpected, this approach to investing encourages us to think outside the box and find common ground. So, let’s embark on this journey with an open mind and a willingness to embrace the possibilities that crossover investing has to offer, and discover how it can be a game-changer for us all.

Frequently Asked Questions

What are the key benefits of crossover investing for individual investors looking to diversify their portfolios?

For individual investors, crossover investing offers a thrilling ride of diversification, reduced risk, and potentially higher returns. By merging the best of private and public investing, you can tap into a broader range of opportunities, from growth-stage startups to pre-IPO funding, and enjoy a more balanced portfolio – it’s like finding the perfect mismatched sock pair, unexpectedly harmonious!

How do crossover investors navigate the complexities of pre-IPO funding and late-stage venture investments?

Navigating pre-IPO funding and late-stage ventures is like building a Rube Goldberg machine – each piece must fit perfectly. Crossover investors carefully analyze growth potential, market trends, and financials to make informed decisions, often leveraging their network and expertise to mitigate risks and maximize returns.

Can crossover investing be applied to various asset classes, or is it primarily focused on technology and startup investments?

Crossover investing isn’t limited to tech and startups; it can be applied to various asset classes, like real estate or art, wherever there’s a blend of financial returns and social impact. Think of it like my Rube Goldberg machines – each piece, no matter how different, works together in harmony.