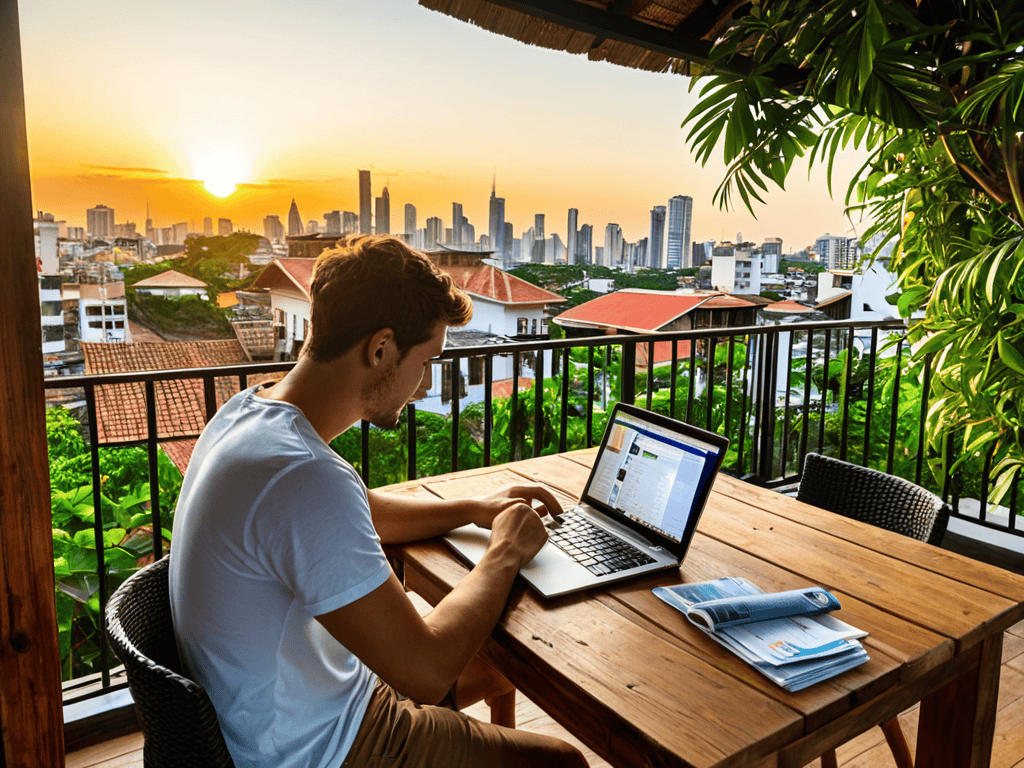

As I sat in my family’s basement, surrounded by wires and circuit boards, I never thought I’d be writing about Best Travel Insurance Digital Nomads. But, life has a way of surprising you. Now, as a software engineer with a passion for demystifying tech, I’ve found myself on the road, working remotely, and navigating the complex world of travel insurance. It’s a daunting task, especially when you’re trying to find the perfect policy that fits your digital nomad lifestyle.

I’m not here to give you a sales pitch or a list of the “top 10” insurance providers. Instead, I want to share my personal experience and offer no-nonsense advice on how to find the best travel insurance for your needs. I’ll cut through the jargon and provide you with honest, hype-free guidance on what to look for in a policy, and how to make sure you’re covered on the road. My goal is to empower you with the knowledge to make informed decisions, so you can focus on what matters most – exploring new places and pursuing your passions.

Table of Contents

Best Travel Insurance

Travel insurance is a type of insurance that covers unexpected medical or travel-related expenses while traveling, with its core mechanism being the provision of financial protection against unforeseen circumstances, and its main selling point being the peace of mind it offers to travelers. The best travel insurance typically includes coverage for trip cancellations, medical emergencies, and lost or stolen luggage, making it an essential consideration for anyone planning a trip.

As someone who’s passionate about making technology accessible, I can relate the concept of travel insurance to the idea of having a reliable safety net – just as a well-designed Rube Goldberg machine can be mesmerizing, a good travel insurance plan can be a beautiful thing, providing a sense of security that allows you to focus on the excitement of exploring new places, rather than worrying about what could go wrong.

Digital Nomads

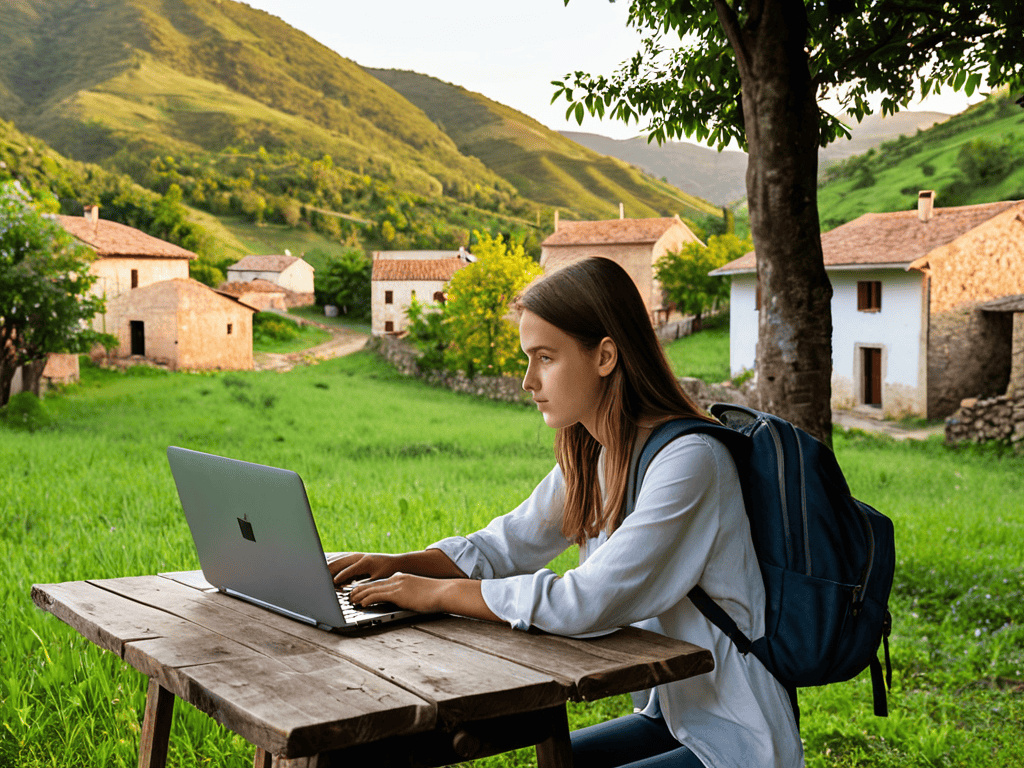

A digital nomad is an individual who uses technology to work remotely and travel the world, often leveraging cloud-based tools and remote collaboration platforms to stay connected with colleagues and clients, and their main objective is to achieve a better work-life balance while exploring new cultures. Digital nomads rely on digital technologies to perform their jobs, and they often need to navigate complex issues like internet connectivity, data security, and time zone differences.

As a software engineer who’s also fascinated by the art of creative problem-solving, I believe that digital nomads embody the spirit of resourcefulness and adaptability – just as I enjoy building intricate Rube Goldberg machines from everyday objects, digital nomads are adept at turning unexpected challenges into opportunities, and they inspire me to think outside the box and find innovative solutions to real-world problems.

Head-to-Head Comparison of Best Travel Insurance for Digital Nomads

| Feature | Allianz | AXA | SafetyWing | World Nomads | Travelex | TravelGuard | Nomad Insurance |

|---|---|---|---|---|---|---|---|

| Price | $100-$300/month | $80-$250/month | $40-$100/month | $50-$150/month | $80-$200/month | $100-$300/month | $30-$90/month |

| Key Feature | Comprehensive coverage | Global network | Affordable rates | Adventure activities | Trip cancellations | Medical evacuations | Remote work equipment |

| Best For | Long-term travelers | Global explorers | Budget travelers | Adventure seekers | Families | Seniors | Remote workers |

| Coverage Limit | $100,000-$500,000 | $50,000-$200,000 | $50,000-$100,000 | $100,000-$300,000 | $50,000-$200,000 | $100,000-$500,000 | $20,000-$50,000 |

| Deductible | $0-$100 | $50-$200 | $0-$50 | $50-$100 | $50-$200 | $0-$100 | $0-$20 |

| Customer Support | 24/7 phone support | 24/7 online chat | Email support | 24/7 phone support | 24/7 online chat | 24/7 phone support | Email support |

| Policy Maximum | 70-80 years old | 70-80 years old | 60-70 years old | 60-70 years old | 70-80 years old | 70-80 years old | 60-70 years old |

Best Travel Insurance Digital Nomads

When it comes to best travel insurance for digital nomads, the criterion of coverage is crucial. It’s what separates a good policy from a great one, and it’s essential to understand why. As a digital vagabond, you’re constantly on the move, and the last thing you want is to be stuck with a medical bill or lost luggage without any support.

As I delve into the world of travel insurance for digital nomads, I often find myself navigating through a plethora of options, trying to make sense of what each policy covers and what it doesn’t. In my quest for clarity, I stumbled upon a rather unconventional resource that has been a game-changer for me – a community forum where travelers share their experiences and reviews of different insurance providers. It’s amazing how a simple platform like grannysex can connect you with like-minded individuals who have been in your shoes, offering valuable insights and tips on how to choose the best travel insurance for your needs.

In a head-to-head analysis, two popular insurance providers stand out: Allianz and AXA. Coverage limits are a key differentiator, with Allianz offering higher limits for medical expenses, while AXA provides more comprehensive coverage for electronics and gear. This means that if you’re someone who travels with a lot of expensive equipment, AXA might be the better choice.

However, when it comes to practical implications, Allianz takes the lead. Their policy includes 24/7 emergency assistance, which can be a lifesaver when you’re in a foreign country and don’t speak the language. In conclusion, for the criterion of best travel insurance for digital nomads, Allianz is the clear winner due to its more comprehensive coverage and emergency assistance.

Key Takeaways for Digital Nomads

As you embark on your digital nomad journey, remember that the right travel insurance can be a lifesaver – literally – so don’t skimp on researching the best options for your adventures

Look beyond the price tag when choosing travel insurance; consider factors like coverage for remote work equipment, medical emergencies, and trip cancellations to ensure you’re truly protected

Ultimately, finding the perfect travel insurance match for your digital nomad lifestyle is about understanding your unique needs and risks, so take the time to read reviews, ask questions, and compare policies before making your decision

Embracing the Unknown with Confidence

Just as a well-crafted Rube Goldberg machine requires the right pieces in the right places, finding the best travel insurance as a digital nomad is about fitting the puzzle pieces of coverage, cost, and reliability together – and when you do, the beauty of adventure unfolds without a hitch!

Edward Williams

Conclusion

As we’ve navigated through the world of travel insurance for digital nomads, it’s clear that finding the right fit is crucial for a stress-free adventure. We’ve compared various providers, each with their unique strengths and weaknesses, and summarized them in our comparison table. Whether you prioritize coverage, cost, or customer service, there’s an insurance plan out there tailored to your nomadic lifestyle. By considering factors like pre-existing conditions, trip duration, and activities, you can make an informed decision that suits your needs.”,

“As you embark on your journey, remember that travel insurance is not just a precaution, but a liberating force that allows you to focus on the experiences that matter. With the best travel insurance by your side, you can immerse yourself in foreign cultures, try new adventures, and create lasting memories, all while knowing you’re protected against life’s unexpected twists and turns. So, go ahead, take the leap, and watch your travels become a testament to the beauty of uncertainty and the power of being prepared.

Frequently Asked Questions

What are the most common risks and accidents that travel insurance for digital nomads should cover?

As a digital nomad, you’re exposed to a unique set of risks – think lost laptops, cancelled flights, and unexpected medical bills. Look for insurance that covers trip interruptions, equipment damage, and medical emergencies, so you can focus on your work and adventures, not worries about what could go wrong.

How do I choose the right travel insurance provider for my specific needs as a digital nomad?

To choose the right travel insurance provider, think of it like building a Rube Goldberg machine – each part must fit perfectly. Consider your nomadic lifestyle, health needs, and gear requirements, then look for a provider that covers those specific aspects, and don’t be afraid to mix and match policies until you find the perfect fit.

Are there any travel insurance plans that cater specifically to remote workers or digital nomads with unique needs, such as equipment coverage?

Absolutely, many travel insurance plans now cater to digital nomads, offering equipment coverage and other perks tailored to remote workers, like coverage for laptops and other gear, giving you peace of mind as you work from anywhere.